The Indian Sugar Industry is at a very

interesting juncture at this point of time. The sugar cycle has been

conventionally understood as following a 4-5 year cycle; 3 years of increasing

trend followed by 2 years of declining trend. Higher sugarcane production

results in falling sugar prices and non-payment of dues to farmers compelling

them to switch to other crops thereby causing a shortage of sugarcane,

consequently leading to an increase in sugarcane prices, resulting in an

imminent switch back to sugarcane. Such a vicious circle is characteristic of

the Indian sugar production. There is now evidence that this cycle is now

becoming a 2-3 year cycle. Sugar still stands listed in several states under

the purview of the Essential Commodities Act, 1955. Sugar is a politically

sensitive commodity, with strong lobbies including the cane growers, sugar

mills, gur and khandsari producers, consumers of subsidized sugar having a say

in influencing the price. Pressures are often reflected at various central and

state levels, which sometimes have independent interests. The government

through pragmatic policies can remove or at least minimize the infamous sugar

cycle and bring about long term healthy growth of the Indian Sugar Industry and

its stake holders.

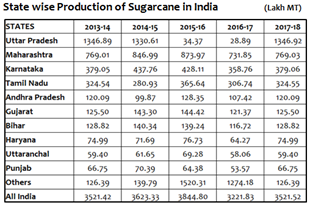

The Indian Sugar Industry, with an annual

productive capacity of over 25 MMT, stands out to be the second largest in the

world after Brazil, accounting for around 15 per cent of the global sugar

production. Uttar Pradesh is leading in producer of sugar with 39.40 per

cent followed closely by Maharashtra (33.74 per cent), Karnataka (7.62 per

cent) and Gujarat (4.23 per cent). The country consumes approximately 25

MT of sugar annually, with Maharashtra contributing over 60 per cent of it

while the rest of the output come from states like Tamil Nadu, Karnataka, Uttar

Pradesh and Madhya Pradesh. In 2017–18, the FRP for cane has been hiked to

Rs 255 per quintal. Besides the cyclical downturn that may have set in leading

to a decline in crop output, deficient rainfall in some of the major sugarcane

producing states of Maharashtra, Karnataka and Tamil Nadu has also been a

contributing factor.

The current production scenario suggests

that we can notice Uttar Pradesh leading the National Sugar Supply amicably

making up for the shortages reported from other states. Indian Sugar Mills Association (ISMA) has revised

country's 2017-18 sugar production upward by about 4 per cent for the current

season to around 261 lakh MT, against the first advance estimates of ISMA of

251 lakh MT. the current year’s sugar consumption is expected to

reach 26 million MT, a marginal increase from the 25.6 million MT estimated for

current year. Bulk consumers account for two-thirds of total sugar consumption

in India which caters to soft drink manufacturers, bakeries, hotels,

restaurants and other bulk and individual users. Global S&D reveals that

Brazil and India are the two major players in the global market producing

about 36.44 per cent of global production. Other countries with

significant production are China (5.84 per cent), Thailand (6.25 per cent),

United States (4.39 per cent) and Mexico (3.66 per cent). Though India ranks 2nd in

terms of production, it is the largest consumer of sugar with global share of

15.15 per cent. Other major consumers of sugar are China (9.21 per cent),

Brazil (6.35 per cent) and United States (6.51 per cent). The global sugar

market is likely to end its surplus trend after three consecutive year of

surplus in 2017.

As per the International Sugar Organization, the global sugar

production is likely to be reported at 8.08 million MT higher than consumption

in the current marketing year, as dry weather during the last months of the

crushing period in Brazil’s main cane cultivation areas caused production in

the region to race ahead of market expectations. Meanwhile, production across

India, Russia and Europe and Mexico are expected to see sluggishness due to

fall in international sugar prices. Global output this year will increase

marginally by 7.86 per cent to 184.94 Million MT. Demand will also stay stable

at 174.22 million MT, while stockpiles at the end of 2017-18 will be 40.82

million MT. Going forward the growing demand for ethanol and incentives for ethanol production in Brazil is likely

to bring in some stability in the sugar supply-and-demand equation.

The Indian

sugar industry is also confronting with the perennial issues of Regulation of

FRP, Low Recovery of Sugar from cane, lack of trust and transparency in

weighing of sugarcane and problem of arrears. Some State governments, namely,

Haryana, Punjab, Tamil Nadu, Uttar Pradesh and Uttarakhand have been announcing

their own State Advised Prices (SAPs) which are not based on scientific basis

and are usually higher than the FRP. The SAP does not incentivize efficiency in

terms of better sugar recovery as SAP is not linked to sugar recovery rate

unlike FRP which could be a more logical approach. For Ensuring more

remunerative prices to the farmers Sugar Price Stabilization Fund (SPSF) under

the Sugar Development Fund (SDF) can be created. Recovery rate of sugar mainly

depends on sucrose content in sugarcane, conditions of plant and machinery,

cane supply arrangements in the State and agro-climatic conditions in the

region. Except the agro-climatic condition, which is a natural factor, the

other factors can be influenced by taking appropriate initiatives to improve

recovery rate. Lack of trust and transparency in weighing of

sugarcane is also a concerning factor for dissatisfaction among sugarcane

growers. Government should persuade the state governments/Cane Commissioners

and sugar mills to make adequate arrangements for electronic weigh bridges/machines,

which measure and display the actual weights so as to improve trust and

transparency between these two stakeholders. Apart from production of sugar,

the mills should also develop facilities for production of alcohol, ethanol,

power and other downstream products, which would make the sugar mills as energy

hubs of the country and enable them to pay remunerative price to cane growers.

The current falling prices in the country has

been the major concern for the government in the recent months. According to ISMA, the Government that there is an

immediate need to take action to control the falling prices, for which some of

the stocks could be exported as quickly as possible. The Government has also

appreciated the concern of the sugar sector and agreed that all steps required

to be taken to ensure that the additional sugar stocks gets exported quickly,

will be taken soon. This could include similar steps as taken by the Government

in the past like mandatory sugar exports by each sugar mill in the country.

Since, the quota levy system has been removed, the Sugar prices are determined

by market sentiments and market forces, and the government can’t have much

direct control over it. Everything remains good until the high FRP of sugarcane

results in over-production of cane and sugar. In order to support the industry,

the government may marginally raise the corpus for Sugar Development Fund (SDF)

to Rs. 500 Crore in the Budget for 2018-19. SDF, managed by the food ministry,

is used for lending money to mills at lower interest rates. In order to arrest

the falling prices, the central government has put a ceiling on the amount of

sugar mills can sell by imposing significant minimum stocks for the next two

months to check falling prices. As per the new quota imposed on sugar

sales, in February mills must maintain sugar stock of not less than 83 per cent

of the closing stock on the last day of January in addition to sugar produced

in February, less sugar exported during the month. For March, sugar mills have

to keep not less than 86 per cent of the closing stock on the last date of

February, in addition to sugar produced during March less sugar exported in the

month. There are also indications that the government may allow export of raw

sugar under Duty Free Import Authorization (DFIA) scheme, which was withdrawn

in May 2015. These two measures have become necessary to ensure that the Indian

sugar mills are able to pay the sugarcane arrears of farmers. Moreover, there

are also concerns over development in the neighbouring countries. Pakistan

has hiked the amount of sugar eligible for export subsidies to two million

tonnes from five lakh tonnes in view of excess domestic supplies. In order to

counter such moves, The Central Government hiked the Import duty on

sugar is to avoid any shipment of the sweetener. Apprehending import

of cheaper sugar from Pakistan, the food ministry has pushed for 100 per cent

import duty on the sweetener from 50 per cent to nip in the bud the

possibility of subsidised sugar imports from Pakistan.

No comments:

Post a Comment