Consultancy Service for the people associated with Commodity Business, agriculture, agri-warehousing, collateral funding in agriculture and agri-business Process Automation and would be greatly interested in empanelment as an Agri-Business Expert (Full time or Part Time) which I feel is the first step for going a long way in strengthening the operational and functional excellence of Agriculture Ecosystem.

Saturday, 15 December 2018

Wednesday, 17 October 2018

Monday, 8 October 2018

Copper Bulls Cramped by Chinese Shrinking Demand

The long-term firm demand of copper from China has excessively been down played by the recent trade war between China and US. It is clear from the metals prices that the Chinese economy is slowing down. Trump threw his tariff tantrums as the Chinese government was getting tough on unregulated lending. This declining demand pattern was well reflected in the decelerating growth numbers of Chinese manufacturing sector which has raised immense pressure on policymakers as U.S. tariffs appear to be inflicting a heavier toll on the Chinese economy. A private survey has reflected that the growth in the Chinese factory sector stalled after 15 months of expansion and the export orders are falling sharply. Tensions between the world’s two largest economies have battered prices of resources across the board, but the move in copper is notable because of its heavy use in construction and manufacturing. Further, a weaker global growth outlook caused by an escalating trade dispute is likely to significantly dent the demand. It's not entirely clear how that pans out — the idea that we're going to see a resolution in October or November looks unlikely as US has reiterated that it was “too soon” for Washington to talk to Beijing about working out a deal on trade, suggesting U.S. tariffs have yet to exert enough pressure to force Beijing into making concessions at the negotiating table, so a protracted battle means again as we look into 2019, the growth trajectory looks uncertain, so that growth would need to be upgraded before more investors gets meaningfully associated.

Investors also need to keen monitor the swings in the dollar, as for much of the year, a stronger dollar has made copper and other commodities denominated in the U.S. currency more expensive for overseas buyers. The dollar climbed to a 15-month high in August but has since come down 0.8 per cent, relieving some pressure on commodities. While US-China trade tensions are unlikely to fade, China’s growth-supportive policy response will likely spur a year-end rally in some of the weakest performing commodities sectors. Copper, often considered a bellwether of global growth, gained 5 per cent in September, helped by optimism that broader US tariffs would prompt China to invest more heavily in areas like infrastructure to support its domestic economy.

Amidst, the increased uncertainties in the global economic scenario, the supply and demand has also changed marginally. The supply of copper has improved while the demand has slowed down. On the demand side, World mine production is estimated to have increased by 5 per cent in the first half of 2018, with concentrate production rising by 5 per cent and solvent extraction-electro-winning (SX-EW) by 6 per cent: The increase in world mine production of about 485,000 t copper was mainly due to constrained output in the comparative period of 2017 namely in Chile and Indonesia, production in Chile, the world’s biggest copper mine producing country, increased by 12 per cent primarily because production in February/March 2017 was restricted by a strike at Escondida (the world’s biggest copper mine) and because there is an improvement in Codelco’s production levels in 2018, Indonesian output increased by 40 per cent because comparative output in 2017 was negatively affected by a temporary ban on concentrate exports that started in January and ended in April. and a 16 per cent increase in SX-EW production in the Democratic Republic of Congo (DRC) and a 12 per cent rise in Zambian mine output due to the restart of temporarily closed capacity. Although no major supply disruptions occurred in the first half of this year, overall growth was partially offset by lower output at some mines in Canada (-7 per cent) and in the United States (-8 per cent). After a strong increase in the last few years due to new and expanded capacity, output in Peru (the world’s second largest copper mine producing country) has levelled off. On a regional basis, mine production is estimated to have increased by around 10 per cent in Africa, 8 per cent in Latin America, 5.5 per cent in Asia, 3 per cent in Europe and 8 per cent in Oceania and declined by 6 per cent in North America.

World refined production is estimated to have increased by 2 per cent in the first half of 2018 with primary production (electrolytic and electro-winning) rising by 0.3 per cent and secondary production (from scrap) increasing by 9 per cent. In tonnage terms, the main contributor to growth in world refined production was China due to its continued expansion of capacity. Production in Chile was up by 6.5 per cent supported by a 4.7 per cent increase in electro-winning (SX-EW) production mainly because comparative output in 2017 was constrained by the strike at Escondida referred to previously. In addition, primary electrolytic production increased by 10 per cent mainly due to improved production at Codelco. Production in Indonesia and Japan was also substantially higher, recovering from reduced output last year as a consequence of a strike and maintenance shutdown. Increases in electro-winning (SX-EW) output in the DRC and Zambia also contributed to world refined production growth. However, overall growth was partially offset by a 20 per cent decline in India’s output due to the shutdown of Vedanta’s Tuticorin smelter in April and declines in production in Poland and the United States as a consequence of maintenance shutdowns. On a regional basis, refined output is estimated to have increased in Africa (11 per cent), Asia (2 per cent) and Latin America (5 per cent) while remaining essentially unchanged in Europe and declining in North America (2.5 per cent) and Oceania (5 per cent).

On the demand side, world apparent refined usage is estimated to have increased by about 1 per cent in the first half of 2018. China was the biggest contributor to growth with apparent usage (excluding changes in unreported stocks) increasing by 4 per cent, driven by a 17 per cent increase in net refined copper imports (as Chinese customs have temporarily suspended the publication of copper trade data since March, exports are calculated based on reversed trade and are likely to be revised). Preliminary data indicates that world ex-China usage declined by 1.5 per cent. Among other major copper using countries, demand increased in India and the EU but declined in the United States and remained essentially unchanged in Japan.

Over recent weeks and months, new trade agreements have calmed the waters for international commerce. The U.S. and European Union have come close to an agreement. The most significant issue facing the copper market, industrial commodities, and the companies that produce them has been the trade dispute between the U.S. and China. Commodities are on the front lines of the conflict which creates barriers for the flow of the raw materials around the world, and copper is no exception. China is the leading consumer of these commodities, and the trade issues have weighed on the Chinese economy. The escalation of the trade dispute over recent weeks continues to stand in front of any substantial comeback in the price of copper. I continue to believe that the solution to the current dispute will come from an economic summit between China's President Xi and U.S. President Trump in the coming weeks or months and the copper would re-embark on positive trend.

Thursday, 27 September 2018

NBHC’s First Kharif Crop Estimates for 2018-19

With

the Kharif Sowing almost on the verge of completion we at NBHC are releasing

our 1st Kharif Crop Estimate - 2018-19. On the Monsoon front,

India's monsoon, which irrigates more than half of the country's farmland, is

below an earlier forecast of normal showers. Backed by good monsoon rainfall

last year India had produced record 284.83 MT of food grains in the 2017-18, this

year highly erratic monsoon and its obscure spread may reduce food grain output

in the ongoing Kharif season. As per our analysis and industry’s feedback on

the sowing progress and the status of the current crop, the total Kharif

Cereals production is likely to decline marginally by 1.71 per cent. Despite heavy rains after the second half of August

and first week of September, which caused floods across Bihar, Kerala, Assam

Gujarat, and Himachal Pradesh, as many as 254 districts (total 640 districts

~ 40%) are faced with drought like situation this monsoon. The

country has been affected by heavy rains in some states leading to massive

flooding while the other states are dealing with significantly deficient and

draught like situations. Based on the above

conditions we fell that the total Kharif crop production scenario for the year

2018-19 would turn out to be as explained in table given below.

Total Rice is expected to show a marginal improvement in area and

production by 4.67 per cent and 1.21 per cent. Within the rice segment, Basmati

Rice area and production is expected to decrease by 2.25 per cent and 7.15 per cent

respectively, whereas the Non-Basmati rice is expected to increase marginally

by 4.96 per cent and 1.73 per cent. Maize is expected marginal lower in area at

1.66 per cent and significant decline in production at 9.64 per cent, as many

farmers shifted to other remunerative crops, few districts in Karnataka and Maharashtra, major growers of

the crop, got less rains and experienced pest infestation which would have

result in yield loss. Maximum Decline is expected in Ragi

whose production is expected to fall by 23.88 per cent while its area is likely

to shrink by 18.90 per cent. Lack of remunerative income has led Jowar &

Bajra farmers to shift their cropping pattern to other cash crops.

In the pulses sector, we expect the area under Moong to increase by 7.95

per cent whereas the production is expected to rise sharply by 26.07 per cent.

Arhar area is expected to increase by 5.10 per cent and the production is

expected to experience an increase of 3.06 per cent. Urad area and production

is expected to be low by 9.52 per cent and 1.89 per cent respectively. Overall,

the total Kharif pulses area and production is likely to decline marginally by 3.75

per cent and 1.80 per cent respectively over last year.

The oil seed sector is likely to see a marginal decline in production by

3.92 per cent. The decline in production is expected to the tune of 50.67 per

cent, 28.49 per cent, 21.84 per cent and 17.36 per cent for Niger, Castor,

Groundnut and Sunflower respectively. Soybean is the only oilseed crop where area

is expected to be up by 6.57 per cent and the production is expected to increase

by 12.20 per cent for the coming season.

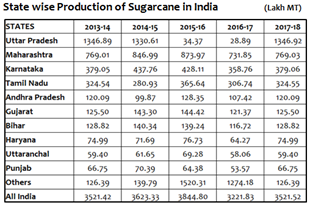

In this current

monsoon season, the cash crop section is likely to show an overall neutral

scenario as only the area for Sugarcane is expected up by 4.06 per cent whereas

Jute & Mesta and Cotton is down by 0.70 per cent and 2.46 per cent

respectively. In terms of production significant rise of 10.11 per cent is

expected in sugarcane while marginal decline of 0.15 per cent and 4.84 per cent

is expected in Jute & Mesta and Cotton respectively.

Tuesday, 25 September 2018

Trade War Continues to Take Its Toll on Copper Market

The indecisive sentiment of copper market continues to rule the market over the continued escalation of trade tensions between the United States and China. The supply-demand statistics have for the meantime taken a back seat and the trade directions with regards to the fallout of the trade war have gained impetus. The Global manufacturing activity has already taken a hit from weak orders in August, as a survey showed, a sign that companies are feeling the pinch from the intensifying Sino-U.S. trade war that could derail global growth. Currently, the falling inventories at London Metal Exchange and Shanghai Futures Exchange-approved warehouses are keeping physical prices high in China, as copper premiums are currently at $91 a tonne, close to a near two-year high of $86 (as on November 2016). But, the absence of fresh inflows into warehouses projects a very nervous and twitchy market situation, as there is no real direction to follow and investors, in particular, seem to be trading metals on the basis of influences from other markets. In spite of the strong fundamentals, the copper market may for the short term, embark on a bearish dive if the global currencies continue to weaken significantly following the Turkish route.

The weakness in the red metals is also been accredited to the increasing uncertainty in the currency market as investors are fleeing to the relative safety of the dollar amid Turkey's financial woes and as concern grows that a U.S.-China trade spat will curb economic growth and put more countries under pressure of the steep rising of global debt. Argentina is already feeling the pressure as its peso crashed to a historic low. While previous debt crises involved U.S. households and, later, profligate European governments such as Greece, this time the concerned center's on companies in emerging markets that have borrowed heavily in dollars and euros. The Global debt loads have exploded since the Great Recession in 2008. From $97 trillion in 2007, total household, corporate and government debt grew to $169 trillion last year. The crises are likely to deepen further if FED continues to raise its interest rate in the midst of a healthier U.S. (U.S. dollar, now at its highest level in 13 months). For emerging markets that borrowed in dollars and euros, rising interest rates will make it more expensive to borrow new money or refinance existing debt. That could trigger a wave of defaults by corporate borrowers, with problems spreading far beyond Turkey and ultimately big debt bubble for the United States which can lead to a global financial crisis.

As per the basic fundamentals of copper trade are concerned, the supply continues to improve amidst lesser strikes compared to last year. World mine production is estimated to have increased by 5.7 per cent in the first five months of 2018, with concentrate production rising by 5.5 per cent and solvent extraction-electro-winning (SX-EW) by 6 per cent. The increase in world mine production of about 450,000 t copper was mainly due to constrained output in the comparative period of 2017 namely in Chile and Indonesia, production in Chile, the world's biggest copper mine producing country, increased by 13.5 per cent primarily because production in February/March 2017 was restricted by a strike at Escondida (the world's biggest copper mine) and also because there was an improvement in Codelco's production levels in 2018, Indonesian output increased by 43 per cent because comparative output in 2017 was negatively affected by a temporary ban on concentrate exports that started in January and ended in April and a 12.5 per cent increase in SX-EW production in the Democratic Republic of Congo (DRC) and a 13 per cent rise in Zambian mine output due to the restart of temporarily closed capacity. Although no major supply disruptions occurred in the first five months of this year, overall growth was partially offset by lower output at some mines in Canada (-8.5 per cent) and in the United States (-10 per cent). After a strong increase in the last few years due to new and expanded capacity, output in Peru (the world's second largest copper mine producing country) has levelled off. On a regional basis, mine production is estimated to have increased by around 11 per cent in Africa, 8.5 per cent in Latin America, 6 per cent in Asia, 3.5 per cent in Europe and 10 per cent in Oceania and declined by 7.5 per cent in North America. World refined production is estimated to have increased by 2 per cent in the first five months of 2018 with primary production (electrolytic and electro-winning) rising by 0.5 per cent and secondary production (from scrap) increasing by 9 per cent. In tonnage terms, the main contributor to growth in world refined production was China due to its continued expansion of capacity. Production in Chile was up by 6.5 per cent supported by a 5.5 per cent increase in electro-winning (SX-EW) production mainly because comparative output in 2017 was constrained by the strike at Escondida referred to previously. In addition, primary electrolytic production increased by 9 per cent mainly due to improved production at Codelco. Production in Indonesia and Japan was also substantially higher, recovering from reduced output last year that was due to a strike and maintenance shutdown respectively. Increases in electro-winning (SX-EW) output in the DRC and Zambia also contributed to world refined production growth. However, overall growth was partially offset by declines in India (shutdown of Vedanta's Tuticorin smelter/refinery in April), in Peru, Poland and the United States. On a regional basis, the refined output is estimated to have increased in Africa (11 per cent), Asia (2 per cent) and Latin America (4.5 per cent) while remaining essentially unchanged in Europe and Oceania and declining in North America (3 per cent). In a major development in India, the refined production in Tuticorin has been stopped which is costing the company around US$ 100 million annually. The smelter has been at a standstill since late March and was sealed by government authorities in May following public, fatal protests against the operation and expansion of the smelter. Vedanta is currently trying to counter the closure and gain access to its facilities using legal means and side by side wants to carry out necessary maintenance work on a leak in the sulphuric acid facility.

On the demand side, the buying spree took off after Beijing announced two weeks ago it would hit $16 billion worth of U.S. imports, including scrap metal (the United States is one of China's biggest copper scrap suppliers), with duties of 25 per cent from Aug. 23 in retaliation for a similar move by Washington. World Copper consumption between January-June 2018 was 11.57 million MT as against 11.53 million MT in 2017. WBMS estimates that imports of refined copper into China were about 350000 MT in June bringing it to 1.86 million MT. Chinese estimated demand for January to June 2018 was 5981 kt which is 5% above the previous year's total and represented over 51% of the global total. Thus, we can see that China's Demand can alone support the global copper market and is nothing to fear for the long-term investors in copper.

Friday, 31 August 2018

Monday, 9 July 2018

Global Trade War Fear Blows off Copper from its High

The global copper market is currently at the receiving end amidst growing economic tensions as the difference between the US and China's Trade relations widened further. The tightening of trade relations has resulted in weak demand from China where its manufacturing sector is slowing down. From 6th of July 2018, US is due to begin enforcing tariffs on more than $30 billion (25.8 billion euros) in Chinese imports as retribution for what Washington describes as Beijing’s theft of US technology and other unfair trade practices. Amidst fear of its implementation, the Chinese currency has already slid to the 11-month low. Reciprocating the US move, China is also likely to respond with its own tariffs immediately. The recent slump in the global copper prices has given a strong jolt to Chile’s copper economy which responsible for almost a third of global production.

Regarding the copper supplies, the market is likely to experience a persistent undersupply over the coming years, as global consumption growth, driven by China's power and infrastructure sectors and increasingly by rising electric vehicle (EV) production, continues to outpace supply growth. As per the current levels is concerned, world mine production is estimated to have increased by 7.1 per cent in the first quarter of 2018, with concentrate production rising by 7 per cent and solvent extraction-electro-winning (SX-EW) by 7.3 per cent. The increase in world mine production, of about 330,000 MT copper, was mainly due to constrained output in the comparative period of 2017 namely in Chile and Indonesia. Production in Chile, the world’s biggest copper mine producing country, increased by 19 per cent mainly because production in February/March 2017 was constrained by a strike at Escondida (the world’s biggest copper mine) and also due to an improvement in Codelco’s production levels. Indonesian output increased by 58 per cent because comparative output in 2017 was negatively affected by a temporary ban on concentrate exports that started in January and ended in April. A 9.5 per cent increase in SX-EW production in the Democratic Republic of Congo (DRC) and a 16 per cent rise in Zambian mine output due to the restart of temporarily closed capacity. Although no major supply disruptions occurred in the first quarter of this year, overall growth was partially offset by lower output at some mines in Canada (-10 per cent) and in the United States (-7.5 per cent). After a strong increase in the last few years due to new and expanded capacity, output in Peru (the world's second-largest copper mine producing country) has levelled off. On a regional basis, mine production is estimated to have increased by around 11 per cent in Africa, 7 per cent in the Americas, 6 per cent in Asia, 4 per cent in Europe and 5 per cent in Oceania.

World refined production is estimated to have increased by 3 per cent in the first quarter of 2018 with primary production (electrolytic and electro-winning) rising by 2.3 per cent and secondary production (from scrap) increasing by 6 per cent. In tonnage terms, the main contributor to growth in world refined production was China due to its continued expansion of capacity. Production in Chile was up by 8 per cent supported by a 9.5 per cent increase in electro-winning (SX-EW) production mainly because comparative output in 2017 was constrained by the strike at Escondida referred to previously. In addition, primary electrolytic production increased by 6 per cent mainly due to improved production at Codelco. Production in Indonesia and Japan was also substantially higher, recovering from constrained output last year that was due to a strike and maintenances shutdown respectively. Increases in electro-winning (SX-EW) output in the DRC and Zambia also contributed to world refined production growth. However, overall growth was partially offset by declines in Peru, Poland, and the United States. On a regional basis, a refined output is estimated to have increased in Africa (7 per cent) and Asia (4 per cent) while remaining essentially unchanged in Europe and in the Americas.

On the Demand side, China was the biggest contributor to growth with usage increasing by around 5 per cent. This was driven by a 10 per cent increase in net refined copper imports. Usage in the rest of the world fell by about 1 per cent. The global refined copper balance for the first quarter of 2018 indicates a surplus of about 150 000 MT. Thus we can see that the balance for the long-term copper fundamentals is strongly tilted towards, the positivity in the prices, though the short-term balance has been disturbed owing to the possibility of Trade War between US and China.

In the recent development, copper bulls have been growing increasingly worried about signs of a slowdown in China’s own manufacturing engine, with fixed asset investment and purchasing manager indices weakening. The state-controlled Chinese Media have already started to use words such as “irrational overreaction” and warn investors, not to panic, which hints towards a bigger uncertainty in the Chinese economy. The US initially have applied 25 per cent tariffs on a list of goods worth $32 billion annually on about 818 product categories. The second tranche of 284 goods valued at $16 billion — which would bring the total to $50 billion is also on the cards. The tariffs hit a broad spectrum of Chinese goods — like passenger vehicles, radio transmitters, aircraft parts and computer hard drives. China, on the other hand, has targeted vehicles and many agricultural and food products, such as soybeans, which would hit US farmers hard.

On the global economic front, copper prices fell to their lowest level in nearly a year, weighed down by weak global manufacturing data and a rising dollar. A private study has shown that growth in China’s manufacturing sector dropped in June, raising concerns over the effect of an intensifying trade conflict with the U.S. China is the world’s largest consumer of copper and many other raw materials. Manufacturing activity in the Eurozone also slowed. The weaker numbers raised concerns over demand for copper, which is used extensively in manufacturing and construction.

In spite of the negativity being spread owing to the fear of trade war, the fundamental support is still strongly supporting the market. The resulting supply gap was filled by the large influx of scrap copper into the Chinese marketplace and that largely balanced the year's copper supply-demand equation. According to the International Copper Study Group, there was a deficit of 135,000 MT over the year or a little more than two days of world demand. The new Chinese policy was partially implemented early this year with a ban on low-grade scrap and has resulted in a significant drop in their scrap imports. It has also caused some low-grade material (e.g., motor windings, insulated copper wire) to go into other Asian markets for upgrading before making its way into China. The spot price of copper may have fallen, but the spreads remain tight, which is a much clearer indicator of pure physical market dynamics. Lastly, the big hedge funds have the tendency to swing the copper price up and down whilst trying to manage risk and run multi-asset strategies, as there is a correlation at a higher level, but the fundamentals must never be forgotten, because when the dust settles, the price momentum can come back with a double-quick pace.

Friday, 8 June 2018

Copper Price Boom to Sustain Amidst Global Supply Deficit

The recent price boom in the copper market is expected to sustain amidst wide spread uncertainties in the global red metal trade. The turmoil of China - United States trading relation heat is being well reflected in the upswing of the prices of major base metals. The negative trade signals created by the sanctions against Rusal leading to lower Russian exports is likely to be well compensated by the restarts of U.S. capacity and excess capacity in China. The strong demand from China continues to drive the global copper market. Most of the significant price levels breached since the US election have seemed to coincide with SHFE traders seizing technical signals. In spite of all fingers being pointed at speculators, the higher price environment has made fundamental sense because of the need for an incentive price that can avoid huge supply gaps post 2020. In the current scenario, if something is not done on immediate basis to breach the supply gap, the prices may be poised to soar up to new highs in the coming months.

The global supply reserves available for mining, according to the US Geological Survey (USGS), is 2.1 billion MT with the most common deposit being porphyries, representing 1.8 billion MT. By far the country with the most reserves is Chile, at 170 million MT, while Australia is second at 88 million MT and Peru a close third at 81 million MT. JORC-compliant reserves for Australia though are only about 24 million MT. So, really the top two copper depositories are Chile and Peru. The United States has 45 million MT of reserves, around the same as Mexico. In terms of production, in 2017 Chile produced the most copper, 5.3 million MT, with Peru second at 2.3 million MT and the China third with 1.8 million MT. The US cranked out 1.2 million MT of copper last year. Total mined production was just less than 20 million tonnes in 2017. The top four copper companies produce around two-thirds of the metal, and the 10 biggest firms produced $644 billion worth of copper in 2017 at a price of $3.10 a pound, according to stats from Infomine. The top 10 copper companies are, in order, Codelco, Freeport McMoRan, Glencore, BHP Billiton, Southern Copper, KGHM Polska Miedz, Rio Tinto, First Quantum, Antofagasta and Vale.

The positive news of expansion of copper supplies came from the Chinese quarter, where Chinalco begun a $1.3 billion expansion of its Toromocho mine in Peru, which would raise copper output by 45 per cent to 300000 MT by 2020. On the global front, World mine production is estimated to have increased by around 4.8 per cent in the first two months of 2018, with concentrate production rising by 4.5 per cent and solvent extraction-electro-winning (SX-EW) by 6 per cent. The increase in world mine production, of about 150,000 MT copper, was mainly due to Constrained output in the comparative period of 2017 namely in Chile and Indonesia. Production in Chile, the world’s biggest copper mine producing country, increased by 13.5 per cent mainly because production in February 2017 was constrained by a strike at Escondida (world biggest copper mine). Indonesian output increased by 40 per cent because comparative output in 2017 was negatively affected by a temporary ban on concentrate exports that started in January and ended in April. A 10 per cent increase in SX-EW production in the Democratic Republic of Congo (DRC) and a 16 per cent rise in Zambian mine output due to the restart of temporary closed/reduced capacity. Although no major supply disruptions occurred in this period, overall growth was partially offset by lower output at some mines in Canada (-9 per cent), Mexico (-3.5 per cent), Peru (-2 per cent) and the United States (-9 per cent). On a regional basis, mine production is estimated to have increased by around 11 per cent in Africa, 4 per cent in the Americas, 5 per cent in Asia, 2.5 per cent in Europe and 5 per cent in Oceania. World refined production is estimated to have increased by about 3.3 per cent in the first two months of 2018 with primary production (electrolytic and electro-winning) rising by 3 per cent and secondary production (from scrap) increasing by 4.5 per cent. In tonnage terms, the main contributor to growth in world refined production was China (increase of 3.5 per cent) due to its continued expansion of capacity. Production in Chile was up by 5.2 per cent supported by a 7 per cent increase in electro-winning (SX-EW) production mainly because production in February 2017 was constrained by the strike at Escondida referred to previously. Production in Indonesia and Japan was also substantially higher recovering from constrained output last year that was due to a strike and a maintenance shutdown. Increases in electro-winning (SX-EW) output in the DRC and Zambia also contributed to world refined production growth. However, overall growth was partially offset by declines in refined production in Peru, Poland and in the United States, respectively. On a regional basis, refined output is estimated to have increased in Africa (7 per cent) and Asia (5 per cent) while remaining essentially unchanged in Europe and in the Americas.

On the demand side, copper consumption last year was driven by Chinese growth and expectations of US demand for copper based on statements from President-elect Donald Trump, who promised $1 trillion to help repair America’s crumbling infrastructure. The strong Chinese demand is continuously standing in as the underlying strength. Major push in demand is coming from Beijing-Tianjin-Hebei integration, a $1.5 billion fund that promotes the government’s plan to integrate the economies of Beijing and Tianjin with the surrounding Hebei province and the extensive use of electric cars. China is the leader in the supply of and demand for electric vehicles, overtaking the US in 2016. Six of the 10 biggest EV makers are in China.

The daily movements of the copper price give some idea of short-term global economic fundamentals, since copper is such an important metal for industrial uses. Demand for copper is a good indication of the relative strength of the economy in question. However it takes a higher-level, longer-term view to see what’s really happening in the copper market. And what’s happening is that copper supply is NOT going to be able to keep up with demand in the long-term. Even with expansions at existing mines and the ramp-up of the relatively few new copper mines like Cobre Panama, Radomiro and Toquepalain, it will not be enough to meet the onslaught of demand that is coming from China as it continues to modernize and urbanize, and electric vehicles, which use three times as much copper as regular ones. If the current level of demand (only in China) is to be analysed, the quantum of copper needed is too enormous - If China follows through on its promise to go 100% electric that would mean 2,380 million MT of copper. At the current production rate of 20 million tonnes a year, that’s 119 years’ worth of copper! Just to produce enough copper for electric cars in China. Going by the level of urbanisation and population size, even a mild push towards electric vehicles would lead to significant boost in the demand. Last but not the least, long term investment in copper continues to be a viable option irrespective of the uncertainty prevailing in the near term.

Monday, 16 April 2018

Copper Dips Marginally Amidst Subdued Demand

Over the last quarter the copper prices have dipped by about 9 per cent on news of slackening demand from China, though the long term base fundaments still strongly favours the bulls. Strong global economic growth is driving demand for the red metal. The Organization for Economic Cooperation and Development raised its global growth forecast for 2018 and 2019 to 3.9 per cent from a previous estimate of 3.6 per cent. The agency expects a rebound in trade and global business investment to lead the way for global growth. Although Chinese imports of the metal declined slightly in February on a monthly basis, it rose on a year-over-year basis. In the first two months of 2018, China's unwrought copper imports increased 10.4 per cent from the same period last year and copper concentrate imports rose 14.5 per cent year over year. Moreover, China's Industrial output grew 7.2 per cent year over year in the first two months of 2018 compared with 6.2 per cent last December and above 6.1 per cent projected by analysts. Therefore, the emerging market nation has been showing signs of strong growth despite facing risks like the crackdown on pollution, increasing financial threats and concerns surrounding possibilities of a trade war with Trump-led United States.

The Asian nation is no longer the sole marginal driver of the industrial metals. With US and global growth holding up, the industrial metals will in all likelihood remain supported. On the supply side, there are series of contract negotiations at mines in Chile and Peru, “which may not go smoothly” and so could support prices. World mine production is estimated to have declined by around 2 per cent in 2017, with concentrate production declining by 1.6 per cent and solvent extraction-electro-winning (SX-EW) by 3 per cent: Mine production fell 4 per cent YoY in the 1st half of 2017 due to a series of supply constrains but the situation improved in the 2nd half with output remaining essentially flat YoY but increasing by 10 per cent compared to the 1st half 2017. The reduction in world mine production was mainly due to a 1 per cent decline in Chile, the world’s biggest copper mine producing country which was negatively affected by the strike at the Escondida mine in the first part of the year and lower output from Codelco mines, reductions in concentrate production in Argentina, Canada and Mongolia of 59 per cent, 14 per cent and 14 per cent respectively that were mainly due to lower grades in planned mining sequencing and Argentina’s Alumbrera mine approaching end of life, a 12.5 per cent decrease in Indonesian concentrate production as output was constrained by a temporary ban on concentrate exports that started in January and ended in April and a 12 per cent fall in production in the United States mainly due to lower ore grades, reduced mining rates and unfavourable weather conditions at the beginning of the year. However, these reductions in output were partially offset by 30 per cent and 4 per cent increases in Kazakhstan and Peruvian mine production respectively, with both countries benefitting from new and expanded capacity that was not yet fully available in 2016. Brazil, Mexico, Myanmar, Spain and Sweden also contributed to world growth. On a regional basis, mine production is estimated to have declined in the Americas by 2 per cent, in Asia by 4 per cent and in Oceania by 5 per cent while increasing in Africa and Europe (including Russia) by 2.5 per cent and 2 per cent respectively.

World refined production is estimated to have increased by 0.6 per cent in 2017 with primary production (electrolytic and electro-winning) declining by 0.15 per cent and secondary production (from scrap) increasing by 4.5 per cent. Increased availability of scrap allowed world secondary refined production to increase, notably in China. The main contributor to growth in world refined production was China (increase of 5 per cent), followed by India (6 per cent) and some EU countries where output recovered after maintenance shutdowns in 2016. However, overall growth was offset by a 7 per cent decline in Chile, the second largest refined copper producer, where both primary electrolytic refined production and electro-winning production fell. Production also decreased in the third and fourth ranked refined copper producers, namely, Japan (-4 per cent) and the United States (-12 per cent) mainly due to maintenance shutdowns at several plants. On a regional basis, refined output is estimated to have increased in Africa (1.5 per cent), in Asia (3.5 per cent) and in Europe (3.7 per cent) whilst declining in the Americas (7.5 per cent) and in Oceania (15 per cent). . The supply volume (mining and recycling) is stable at this time. With the long-term forecasts of increasing demand (particularly in China), we may see copper-based wire and cable products increasing in price over at least the next five years.

The copper bears are also fancying their chances as fears of a global trade war take center stage. Copper came under selling pressure after the United States Department of Commerce released its Section 232 findings in mid-February. While other factors also seem to be at play in copper’s price action, the risk of a global trade war seems to be weighing heavily on investors’ minds. Apart from the above major development in the global economy, the demand fundamentals in copper still too strong.

Nearly 50 per cent of the demand for copper comes from the construction industry and 17 per cent from the electrical sector. Copper is also used extensively in heavy and light engineering and in transport industries. The market demand for copper is still rising strongly on the back of phenomenal growth in China, India and other emerging market economies. In China, the growth has been a staggering 15 per cent per year. Stockpiles of copper have been in sharp decline the last few years. It is this scarcity that has driven prices higher while commodities traders out-bid each other as they scramble for available supplies and hedge on futures. Supply has fallen behind the growth of demand and prices can move in only one direction when this happens.

The flexibility in the supply of copper is low. Supply is usually unresponsive to price movements in the short term because of the high fixed costs of developing new extraction processes and plants, which typically involve lengthy lead-times. Due to that pressure, investors seem resistant to investing in new copper mining facilities at this time. If existing copper mining businesses are working close to their current capacity, then a rise in world demand will simply lead to a reduction in available stocks. Current copper supply and demand issues may not bring the market back into equilibrium for many years.

Thursday, 8 March 2018

Improved Growth in Asian Economies to Sustain Buoyancy in Copper

The copper market continues to find increased support from the highly positive growth outlook projected for the Asian Economies. The International Monetary Fund projects an economic growth rate of 6.6 per cent in 2019 for the region, comparable with rates forecasted for 2017 and 2018. This steady growth creates a strong platform for base metals markets, particularly copper. While Asia accounts for more than 60 per cent of global copper demand, the region is woefully lacking in domestic supplies and must import copper to meet that demand. The positivity in the copper is also supported by the fact that the supply crunch brought on by low levels of current aboveground supply, the dearth of new copper discoveries and the lack of new mines coming into production over the past decade. The lack of new copper discoveries around the world has led the big players like BHP and Antofagasta investing in a lot of juniors (Smaller mines), picking up where they can to feed production. In the new strategic shift, the advanced Asian economies such as China, Japan and South Korea are looking to lock the access to high-quality copper deposits through strategic partnerships with junior explorers in mining-friendly jurisdictions.

The current level of S&D analysis, suggest that the mining supply is consistently declining. World mine production is estimated to have declined by 2.4 per cent in the first eleven months of 2017, with concentrate production declining by 2 per cent and solvent extraction-electro-winning declining by 3.5 per cent. The decline in world mine production was mainly due to a 1.6 per cent decline in production in Chile, the world’s biggest copper mine producing country which was negatively affected by the strike at the Escondida mine and lower output from Codelco mines, Reductions in concentrate production in Argentina, Canada and Mongolia of 57 per cent, 15.5 per cent and 15 per cent respectively were mainly due to lower grades in planned mining sequencing and Argentina’s Alumbrera mine approaching end of life, a 14.5 per cent decline in Indonesian concentrate production as output was constrained by a temporary ban on concentrate exports that started in January and ended in April, and 12 per cent decline in production in the United States mainly due to lower ore grades, reduced mining rates and unfavourable weather conditions at the beginning of the year. However these reductions in output were partially offset by 30.5 per cent and 3.7 per cent increases in Kazakhstan and Peruvian mine production, respectively, with both countries benefiting from new and expanded capacity that was not yet fully available in 2016. Brazil, Mexico, Myanmar, Spain and Sweden also contributed to world growth. On a regional basis, mine production is estimated to have declined in the Americas by 2.5 per cent, in Asia by 4.5 per cent and in Oceania by 5 per cent while increasing in Europe (including Russia) by 2.5 per cent and remaining essentially unchanged in Africa.

World refined production is estimated to have slightly increased by 0.5 per cent in the first eleven months of 2017 with primary production (electrolytic and electro-winning) declining by around 1.5 per cent and secondary production (from scrap) increasing by 9 per cent. Increased availability of scrap allowed world secondary refined production to increase, notably in China. The main contributor to growth in world refined production was China (increase of 5 per cent), followed by India (6.5 per cent) and some EU countries recovering from maintenance shutdowns in 2016. However, overall growth was offset by a 7.5 per cent decline in Chile, the second largest refined copper producer, where both primary electrolytic refined production and electro-winning production declined. Production also declined in the third and fourth world leading refined copper producers, namely, Japan (-4 per cent) and the United States (-11 per cent). On a regional basis, refined output is estimated to have increased in Asia (3.5 per cent) and in Europe (3.5 per cent) while declining in the Americas (8 per cent) and in Oceania (15 per cent) and remaining essentially unchanged in Africa (2 per cent).

On the demand side, World apparent refined usage is estimated to have increased modestly by 0.6 per cent during the first eleven months of 2017. Improved scrap supply constrained world refined copper usage growth globally in 2017. Preliminary data indicates that world ex-China usage increased by 0.3 per cent while Chinese apparent usage (currently representing almost 50 per cent of world refined usage) increased by around 0.9 per cent. Chinese apparent usage (excluding changes in unreported stocks) increased by 0.9 per cent as although refined copper production increased by 5 per cent, net imports of refined copper declined by 9 per cent. Among other major copper using countries, usage increased in India and Japan but declined in the United States, Germany and South Korea.

Seeing the developments in the patterns of supply and demand, we can see that the demand is expected to surpass the supplies leading to upside pull in the prices in the months to come. Infrastructural development in major countries such as China and India will continue to sustain growth in copper demand. An interesting technological factor influencing rising copper demand stems from the growth in the electric vehicle (EV) market. As per a study, conventional cars use 23 kilograms of copper compared to 51 kilograms in plugins and 77 kilograms in EVs. This market is expected to grow at a CAGR of 5.2 per cent (by volume) over the forecast period and reach a volume of 2,826,309 MT by 2027 end. Currently, the global automotive wires market is estimated to be about 1,700,440 MT in terms of volume by 2017 end. Moreover, the Chinese government has issued the first two rounds of solid waste import licenses for 2018, and copper scrap import license numbers and tonnages are down by more than 94 percent each. By such moves China has taught the rest of the developing world a valuable lesson as it pertains to acquiring affordable raw materials through the leveraging of their labor markets, the strategy well followed by Japan & South Korea.

Copper demand is highly correlated with global economic activity. With Asia accounting for 69 per cent of the global copper usage, demand from emerging economies, like China and India, significantly impacts the metal's overall demand. In the coming times, copper prices are likely to be supported by supply constraints, such as Chinese scrap import restrictions, potential labour disputes at large mines and a looming shortage further ahead. In China, demand was likely to be driven by power demand and greater investment in electricity infrastructure. Currently, a combination of rising freight rates and anemic physical premiums, particularly for Chinese delivery, has effectively trapped this metal. Overall, Copper demand is expected to rise 2 per cent in 2018, driven primarily by infrastructure development in major countries such as India, China, and the United States resulting in steady support for the copper market.

Friday, 16 February 2018

Sugar Awaits Further Slide on Reports of Higher Production

The Indian Sugar Industry is at a very

interesting juncture at this point of time. The sugar cycle has been

conventionally understood as following a 4-5 year cycle; 3 years of increasing

trend followed by 2 years of declining trend. Higher sugarcane production

results in falling sugar prices and non-payment of dues to farmers compelling

them to switch to other crops thereby causing a shortage of sugarcane,

consequently leading to an increase in sugarcane prices, resulting in an

imminent switch back to sugarcane. Such a vicious circle is characteristic of

the Indian sugar production. There is now evidence that this cycle is now

becoming a 2-3 year cycle. Sugar still stands listed in several states under

the purview of the Essential Commodities Act, 1955. Sugar is a politically

sensitive commodity, with strong lobbies including the cane growers, sugar

mills, gur and khandsari producers, consumers of subsidized sugar having a say

in influencing the price. Pressures are often reflected at various central and

state levels, which sometimes have independent interests. The government

through pragmatic policies can remove or at least minimize the infamous sugar

cycle and bring about long term healthy growth of the Indian Sugar Industry and

its stake holders.

The Indian Sugar Industry, with an annual

productive capacity of over 25 MMT, stands out to be the second largest in the

world after Brazil, accounting for around 15 per cent of the global sugar

production. Uttar Pradesh is leading in producer of sugar with 39.40 per

cent followed closely by Maharashtra (33.74 per cent), Karnataka (7.62 per

cent) and Gujarat (4.23 per cent). The country consumes approximately 25

MT of sugar annually, with Maharashtra contributing over 60 per cent of it

while the rest of the output come from states like Tamil Nadu, Karnataka, Uttar

Pradesh and Madhya Pradesh. In 2017–18, the FRP for cane has been hiked to

Rs 255 per quintal. Besides the cyclical downturn that may have set in leading

to a decline in crop output, deficient rainfall in some of the major sugarcane

producing states of Maharashtra, Karnataka and Tamil Nadu has also been a

contributing factor.

The current production scenario suggests

that we can notice Uttar Pradesh leading the National Sugar Supply amicably

making up for the shortages reported from other states. Indian Sugar Mills Association (ISMA) has revised

country's 2017-18 sugar production upward by about 4 per cent for the current

season to around 261 lakh MT, against the first advance estimates of ISMA of

251 lakh MT. the current year’s sugar consumption is expected to

reach 26 million MT, a marginal increase from the 25.6 million MT estimated for

current year. Bulk consumers account for two-thirds of total sugar consumption

in India which caters to soft drink manufacturers, bakeries, hotels,

restaurants and other bulk and individual users. Global S&D reveals that

Brazil and India are the two major players in the global market producing

about 36.44 per cent of global production. Other countries with

significant production are China (5.84 per cent), Thailand (6.25 per cent),

United States (4.39 per cent) and Mexico (3.66 per cent). Though India ranks 2nd in

terms of production, it is the largest consumer of sugar with global share of

15.15 per cent. Other major consumers of sugar are China (9.21 per cent),

Brazil (6.35 per cent) and United States (6.51 per cent). The global sugar

market is likely to end its surplus trend after three consecutive year of

surplus in 2017.

As per the International Sugar Organization, the global sugar

production is likely to be reported at 8.08 million MT higher than consumption

in the current marketing year, as dry weather during the last months of the

crushing period in Brazil’s main cane cultivation areas caused production in

the region to race ahead of market expectations. Meanwhile, production across

India, Russia and Europe and Mexico are expected to see sluggishness due to

fall in international sugar prices. Global output this year will increase

marginally by 7.86 per cent to 184.94 Million MT. Demand will also stay stable

at 174.22 million MT, while stockpiles at the end of 2017-18 will be 40.82

million MT. Going forward the growing demand for ethanol and incentives for ethanol production in Brazil is likely

to bring in some stability in the sugar supply-and-demand equation.

The Indian

sugar industry is also confronting with the perennial issues of Regulation of

FRP, Low Recovery of Sugar from cane, lack of trust and transparency in

weighing of sugarcane and problem of arrears. Some State governments, namely,

Haryana, Punjab, Tamil Nadu, Uttar Pradesh and Uttarakhand have been announcing

their own State Advised Prices (SAPs) which are not based on scientific basis

and are usually higher than the FRP. The SAP does not incentivize efficiency in

terms of better sugar recovery as SAP is not linked to sugar recovery rate

unlike FRP which could be a more logical approach. For Ensuring more

remunerative prices to the farmers Sugar Price Stabilization Fund (SPSF) under

the Sugar Development Fund (SDF) can be created. Recovery rate of sugar mainly

depends on sucrose content in sugarcane, conditions of plant and machinery,

cane supply arrangements in the State and agro-climatic conditions in the

region. Except the agro-climatic condition, which is a natural factor, the

other factors can be influenced by taking appropriate initiatives to improve

recovery rate. Lack of trust and transparency in weighing of

sugarcane is also a concerning factor for dissatisfaction among sugarcane

growers. Government should persuade the state governments/Cane Commissioners

and sugar mills to make adequate arrangements for electronic weigh bridges/machines,

which measure and display the actual weights so as to improve trust and

transparency between these two stakeholders. Apart from production of sugar,

the mills should also develop facilities for production of alcohol, ethanol,

power and other downstream products, which would make the sugar mills as energy

hubs of the country and enable them to pay remunerative price to cane growers.

The current falling prices in the country has

been the major concern for the government in the recent months. According to ISMA, the Government that there is an

immediate need to take action to control the falling prices, for which some of

the stocks could be exported as quickly as possible. The Government has also

appreciated the concern of the sugar sector and agreed that all steps required

to be taken to ensure that the additional sugar stocks gets exported quickly,

will be taken soon. This could include similar steps as taken by the Government

in the past like mandatory sugar exports by each sugar mill in the country.

Since, the quota levy system has been removed, the Sugar prices are determined

by market sentiments and market forces, and the government can’t have much

direct control over it. Everything remains good until the high FRP of sugarcane

results in over-production of cane and sugar. In order to support the industry,

the government may marginally raise the corpus for Sugar Development Fund (SDF)

to Rs. 500 Crore in the Budget for 2018-19. SDF, managed by the food ministry,

is used for lending money to mills at lower interest rates. In order to arrest

the falling prices, the central government has put a ceiling on the amount of

sugar mills can sell by imposing significant minimum stocks for the next two

months to check falling prices. As per the new quota imposed on sugar

sales, in February mills must maintain sugar stock of not less than 83 per cent

of the closing stock on the last day of January in addition to sugar produced

in February, less sugar exported during the month. For March, sugar mills have

to keep not less than 86 per cent of the closing stock on the last date of

February, in addition to sugar produced during March less sugar exported in the

month. There are also indications that the government may allow export of raw

sugar under Duty Free Import Authorization (DFIA) scheme, which was withdrawn

in May 2015. These two measures have become necessary to ensure that the Indian

sugar mills are able to pay the sugarcane arrears of farmers. Moreover, there

are also concerns over development in the neighbouring countries. Pakistan

has hiked the amount of sugar eligible for export subsidies to two million

tonnes from five lakh tonnes in view of excess domestic supplies. In order to

counter such moves, The Central Government hiked the Import duty on

sugar is to avoid any shipment of the sweetener. Apprehending import

of cheaper sugar from Pakistan, the food ministry has pushed for 100 per cent

import duty on the sweetener from 50 per cent to nip in the bud the

possibility of subsidised sugar imports from Pakistan.

Tuesday, 6 February 2018

Extended Bull Run for Copper Awaits the Current Consolidation

The year 2017 had been a prosperous year for copper as its prices moved higher amidst increased positivity in the market and overall optimism in the demand from China and other user country. The disruptions in supplies also amply supported the bulls which had increased the output costs. As hopes for synchronized economic growth in 2018 rise, there is a brighter outlook for industrial demand of copper. The Asian nation is no longer the sole marginal driver for copper as the US and global growth is holding is demand on the higher side which would ensures that the copper prices in all likelihood remain well supported. The increase prospective demand is also likely to come from the developing economies where infrastructure and urbanisation are essential for reaching the next stage in their expansion.

The supply disruption could be the main stay for the copper market in the year 2018, as this year there are a lot of labor contracts in Chile and Peru coming up and you can expect those negotiations to be challenging and it could be supported from a supply standpoint. In 2017, we saw labor-related incidents at several mines (ANTO) including mines owned by Southern Copper (SCCO) and Teck Resources (TECK). Since copper prices are currently near multiyear highs and commodity markets seem to have put the worst behind them, labor unions might be a bit more demanding during labor negotiations. There are between 20 and 25 collective negotiations expected (locally in Chile & Peru) and if some of them lead to significant strikes that would have a positive impact on prices. Among the most notable mines that will be negotiating labor contracts in 2018 are BHP Billiton’s Escondida, which is the largest copper mine globally. The mine faced a labor action last year that negatively impacted BHP Billiton’s copper production. Chile's state copper commission has predicted a global copper supply deficit of 175,000 tonnes in 2018, versus 67,000 in 2017.

World mine production is estimated to have declined by 2.6 per cent in the first ten months of 2017, with concentrate production declining by 2.2 per cent and solvent extraction-electro-winning (SX-EW) declining by 4.3 per cent. The decline in world mine production was mainly due to a 2 per cent decline in production in Chile, the world’s biggest copper mine producing country which was negatively affected by the strike at the Escondida mine and lower output from Codelco mines, reductions in concentrate production in Argentina, Canada and Mongolia of 55 per cent, 17 per cent and 17 per cent respectively were mainly due to lower grades in planned mining sequencing and Argentina’s Alumbrera mine approaching end of life, a 15 per cent decline in Indonesian concentrate production as output was constrained by a temporary ban on concentrate exports that started in January and ended in April and a 12 per cent decline in production in the United States mainly due to lower ore grades, reduced mining rates and unfavourable weather conditions at the beginning of the year. However these reductions in output were partially offset by 32 per cent and 3.5 per cent increases in Kazakhstan and Peruvian concentrate output, respectively, with both countries benefitting from new and expanded capacity that was not yet fully available in the same period of last year. Brazil, Mexico, Myanmar, Spain and Sweden also contributed to world growth. On a regional basis, mine production is estimated to have declined in Africa by 1 per cent, in the Americas by 3 per cent, in Asia by 4 per cent and in Oceania by 3 per cent while increasing in Europe (including Russia) by 2 per cent. World refined production is estimated to have remained essentially unchanged in the first ten months of 2017 with primary production (electrolytic and electro-winning) declining by around 2 per cent and secondary production (from scrap) increasing by 9 per cent. Increased availability of scrap allowed world secondary refined production to increase, notably in China. The main contributor to growth in world refined production was China (increase of 5 per cent), followed by India (7 per cent) and some EU countries recovering from maintenance shutdowns in 2016. However, overall growth was offset by 8 per cent decline in Chile, the second largest refined copper producer, where both primary electrolytic refined production and electro-winning production declined. Production also declined in the third and fourth world leading refined copper producers, namely, Japan (-4 per cent) and the United States (-10 per cent). On a regional basis, refined output is estimated to have increased in Asia (3 per cent) and in Europe (3.5 per cent) while declining in Africa (2 per cent), in the Americas (8 per cent) and in Oceania (10 per cent).

On the demand side, the key driver for the same would be China since the country accounts for roughly half of global copper consumption. We have witnessed some moderation in China’s construction activity in the second half of 2017. There are also concerns that China’s construction boom, which lifted its economic activity last year, might not continue in 2018. Looking at copper, it’s more of a late cycle metal when it comes to the construction sector, unlike steel which is used in the initial stages of construction. So we might not see much of a negative impact on copper demand in 2018 from the expected slowdown in China’s construction activity. China’s automotive sector has also been strong. Although the sales tax cut, which gave a boost to Chinese car sales, is being completely withdrawn in 2018, it might not have a major impact on China’s automotive sales. China’s industrial sector has also been reasonably strong, which could support copper demand in 2018.

Copper, like other metals, is widely recycled. Last year, we saw improved scrap flows as copper prices moved to higher price levels. Higher scrap flows helped blunt some of the supply shortfall that resulted from strikes at leading mines. Over the last couple of years, China has taken several measures, including curtailing its polluting steel, coal, and aluminum plants, to help reduce the smog during the winter months. Global copper scrap markets might need to readjust themselves since China plans to ban certain grades in 2019. Energy prices tend to impact commodity market sentiments. Along with boosting copper market sentiments, higher energy prices have an impact on copper miners’ production costs. Other factors supporting the bullishness in copper are the passage of the tax reform bill which has raised hopes of growth in the United States and the strengthening of US Dollar owing to expected repatriation of overseas profits.

While the markets focus on Chinese copper demand, the other half of the demand, which is the world ex-China, tends to be overlooked. In 2018, we could see a strong copper demand from the world ex-China. The Federal Reserve raised its outlook for US economic growth in December 2017. Economic activity has been strong in the Eurozone, largely defying concerns over a hard Brexit. Looking elsewhere, economic activity has been reasonably bullish in emerging economies such as India.

Monday, 22 January 2018

NBHC’s First Rabi Crop Estimates for 2017-18

The northeast rainfall of 2017-18 was best since 2013 at 10 per cent below normal but its distribution has created dry and drenched zones. Cyclonic activities (Cyclone Ockhi) gave retreating rainfall down south but have left the North and Central areas of the country considerably dry. According to Indian Meteorological reports the states of Madhya Pradesh and Uttar Pradesh have received below normal rainfall from south west monsoon. The rainfall was deficient by 16 per cent for western MP, 24 per cent for eastern MP, 31 per cent for western UP and 28 per cent for eastern UP. Also the northeast rainfall has been deficient by 95 per cent in UP and 67 per cent in MP. It has spurred a major decrease in Rabi acreage and has specially affected Rabi-wheat sowing in MP and UP.

The total Rabi Cereals production for the year 2017-18 is expected to be lower by 6.65 per cent to 115.40 Million MT owing to scanty and inequitable distribution of rainfall in major growing areas. Wheat is expected to show a decline in area by 3.70 per cent to 30.39 Million Ha and production by 6.33 per cent to 92.16 Million MT over last year owing to lesser crop preference by farmers and expected decline in yield in major growing areas. Rabi rice acreage is recorded lower by 13.48 per cent and its production is expected to decrease by 13.82 per cent due to staggered rainfall. Jowar sowing area is expected to be increase by 6.48 per cent and the production is around 4.26 per cent lower than previous year. Maize production is also expected to decrease by 2.91 per cent and pegged at 6.82 Million MT. Barley, however is the only coarse cereal with positive trend in production and is expected to be 12.77 per cent higher than previous year at 1.96 Million MT.

Chana, Masoor and Field Peas are the pulses that are giving the positive pull to total pulses production. The Gram acreage has increase by 12 per cent and likewise the production is expected to cross 10 lakh MT for the first time in 2017-18. Many of the farmers have shifted to Bengal Gram (Chana) from Wheat as it requires comparatively less moisture from deep soil. Overall, the pulses have shown significant increase in acreage by 9.11 per cent and the production is expected at 14.73 Million MT. Masoor (Lentils) have also shown a surprising uptrend in production and higher stacks have led to uplifting of the export ban. Rabi Masoor production is estimated 25.79 per cent higher at 1.28 Million MT as against 1.02 during 2016-17.

With decrease in Rabi cereal production, the Rabi Foodgrain production is expected to decrease by 4.84 per cent to 130.13 Million MT as compared to 136.75 Million MT reported last year.

Oilseeds however have observed a downtrend in both acreage and production by 8.82 per cent and 9.34 per cent. The decreased production estimates is majorly due to a 13.54 per cent decline in mustard sowing mostly in Rajasthan which has resulted in lowering of the production estimate by 10.63 per cent to 71.28 Lakh MT. As Rajasthan didn’t receive appropriate rain during September-October and higher temperatures during these two months resulted in lower soil moisture levels causing lower sowing. Also, mustard prices during last season had created a disappointment among farmers further weakening the sowing. Sunflower and safflower production for 2017-18 has been estimated lower at 139.83 and 58.67 lakh MT than 143 and 78 lakh MT during 2016-17. Rabi Groundnut production is expected to decrease by 3.52 per cent at 12.95 lakh MT as against 13.43 lakh MT during 2016-17. Odisha has recorded lower Rabi sowing at 0.72 lakh Ha which is less than previous year by 0.18 lakh ha, while Telangana Rabi sowing was recorded 0.13 lakh ha less than previous year at 1.31 lakh Ha.

Saturday, 6 January 2018

Copper to Gain More Positive Traction in 2018

The year 2017 has been quite outstanding for copper and other base metals. In the year 2017, copper demand, especially from China, turned out to be better than expected. China’s housing market proved resilient, while global economic growth also strengthened over the year. There were more surprises on the supply side. Earlier this year, two of the biggest copper mines, Escondida in Chile and Grasberg in Indonesia both experienced prolonged disruptions, while other producers also suffered cutbacks due to declining ore grades and weather factors. Copper exceeded expectations in 2017 as demand proved stronger than expected while supply suffered some major disruptions. LME copper prices were up 26 per cent year to date, reaching $6906/MT on 19th December.

On the supply side, while labour disputes and weather factors continue to pose a risk to supply going forward, we do not expect supply cuts to be as severe as what we’ve seen earlier this year. Combined with capacity restarts in the Democratic Republic of Congo and Zambia and to a lesser extent additional output from new projects and expansions, we expect to see world mine production increase slightly in 2018. Better availability of copper concentrates should see refined production increase as well in 2018. That will however be limited to some extent by China’s recent ban on scrap imports. World mine production is estimated to have declined by around 2.5 per cent in the first nine months of 2017, with concentrate production declining by 1.7 per cent and solvent extraction-electro-winning declining by around 5 per cent. The decline in world mine production was mainly due to a 4 per cent decline in production in Chile, the world’s biggest copper mine producing country, negatively affected by the strike at the Escondida mine and lower output from Codelco mines, a decline in Argentina, Canada and Mongolia concentrates production of 52 per cent, 18 per cent and 18 per cent, respectively, mainly due to lower grades in planned mining sequencing and Argentina’s Alumbrera mine approaching end of life, a 18 per cent decline in Indonesian concentrate production as output was constrained by a temporary ban on concentrate exports that started in January and ended in April, a 11 per cent decline in production in the United States mainly due to lower ore grades, reduced mining rates and unfavourable weather conditions at the beginning of the year. However these reductions in output were partially offset by 34 per cent and 4 per cent increases in Kazakhstan and Peruvian concentrate output, respectively, with both countries benefitting from new and expanded capacity that was not yet fully available in the same period of last year. Brazil, Mexico, Myanmar, Spain and Sweden also contributed to world growth. On a regional basis, mine production is estimated to have declined in Africa by 1.5 per cent, in the Americas by 3.5 per cent, in Asia by 2 per cent and in Oceania by 2 per cent while increasing in Europe (including Russia) by 2.5 per cent. World refined production is estimated to have grown modestly by 0.5 per cent in the first nine months of 2017 with primary production (electrolytic and electro-winning) declining by 1.3 per cent and secondary production (from scrap) increasing by 9.5 per cent. Increased availability of scrap allowed world secondary refined production to increase, notably in China. The main contributor to growth in world refined production was China (increase of 6 per cent), followed by India (7.5 per cent) and some EU countries recovering from maintenances shutdowns in 2016. However, overall growth was offset by a 10 per cent decline in Chile, the second largest refined copper producer, where both primary electrolytic refined production and electro-winning production declined. Production also declined in the third and fourth world leading refined copper producers, namely, Japan (-3.7 per cent) and the United States (-8.5 per cent). On a regional basis, refined output is estimated to have increased in Asia (4 per cent) and in Europe (4 per cent) while declining in Africa (2 per cent), in the Americas (9 per cent) and in Oceania (8.5 per cent).

World apparent refined usage is estimated to have increased modestly by around 0.5 per cent in the first nine months of 2017. Improved scrap supply is constraining world refined copper usage growth globally in 2017. Preliminary data indicates that world ex-China usage might have increased by about 1 per cent. However, China apparent usage (currently representing almost 50 per cent of world refined usage) remained essentially unchanged. Chinese apparent usage (excluding changes in unreported stocks) remained essentially unchanged as although refined copper production increased by 6 per cent, net imports of refined copper declined by 13 per cent. Among other major copper using countries, usage increased in India and Japan but declined in the United States, Germany and South Korea. The demand outlook for the red metal remains positive with expectations of a recovery in Chinese demand. This has been driven by President Trump’s plans to boost spending on infrastructure and construction, depreciation of the US dollar and the rising use of copper in electric vehicles and other electrical applications. The primary boost is expected to come from the recovery of the Chinese economy as the country continues its transitions towards a domestic demand driven economy.

The global copper market is eyeing at China’s ambitious USD 4 Trillion One Belt, One Road (OBOR) infrastructure development plan that aims at developing trade corridors across Asia, Europe, Africa and Middle East which would further drive demand. Other notable factors which are expected to drive the demand of the red metal include the rising production of electric cars, which use four times the amount of copper than a vehicle with a traditional combustion engine. According to International Copper Association, copper demand from electric vehicles is expected to be nine times higher by 2027 from the current level of 185,000 MT. Owing to the above expansion plan, the IMF has recently revised China’s GDP growth forecast for 2017 and 2018 to 6.7 per cent and 6.4 per cent respectively, reflecting the high levels of public investment in the country which augurs well for the steady and continued copper demand in the country.

Copper is currently in a supply deficit which is likely to increase over the next three years. As the global copper deficit intensifies and the price outlook remains strong, miners can be seen to focus on the expansion and development of new projects to meet increased demand. Production from brownfield expansions at Escondida in Chile, the restart of Glencore’s African copper operations, First Quantum Minerals’ new Cobre Panama mine and OZ Minerals’ construction of the Carrapateena copper mine in South Australia are expected to come online and increase output in the future. Prospects of a Chinese economic recovery, rising demand from electric vehicle manufacturers and US infrastructure plans announced following the election of President Trump are all driving copper demand. Meanwhile, labour disruptions, declining ore grades and a lack of new capacity are constricting supply, thereby resulting in a tightening market. Thus, we can see that irrespective of prospects of marginal increase in supply is on the cards, the supply deficit is expected expand further and leading to increased bullishness and it won’t be a surprise if we see new record high levels before the end of 2018.

Subscribe to:

Comments (Atom)